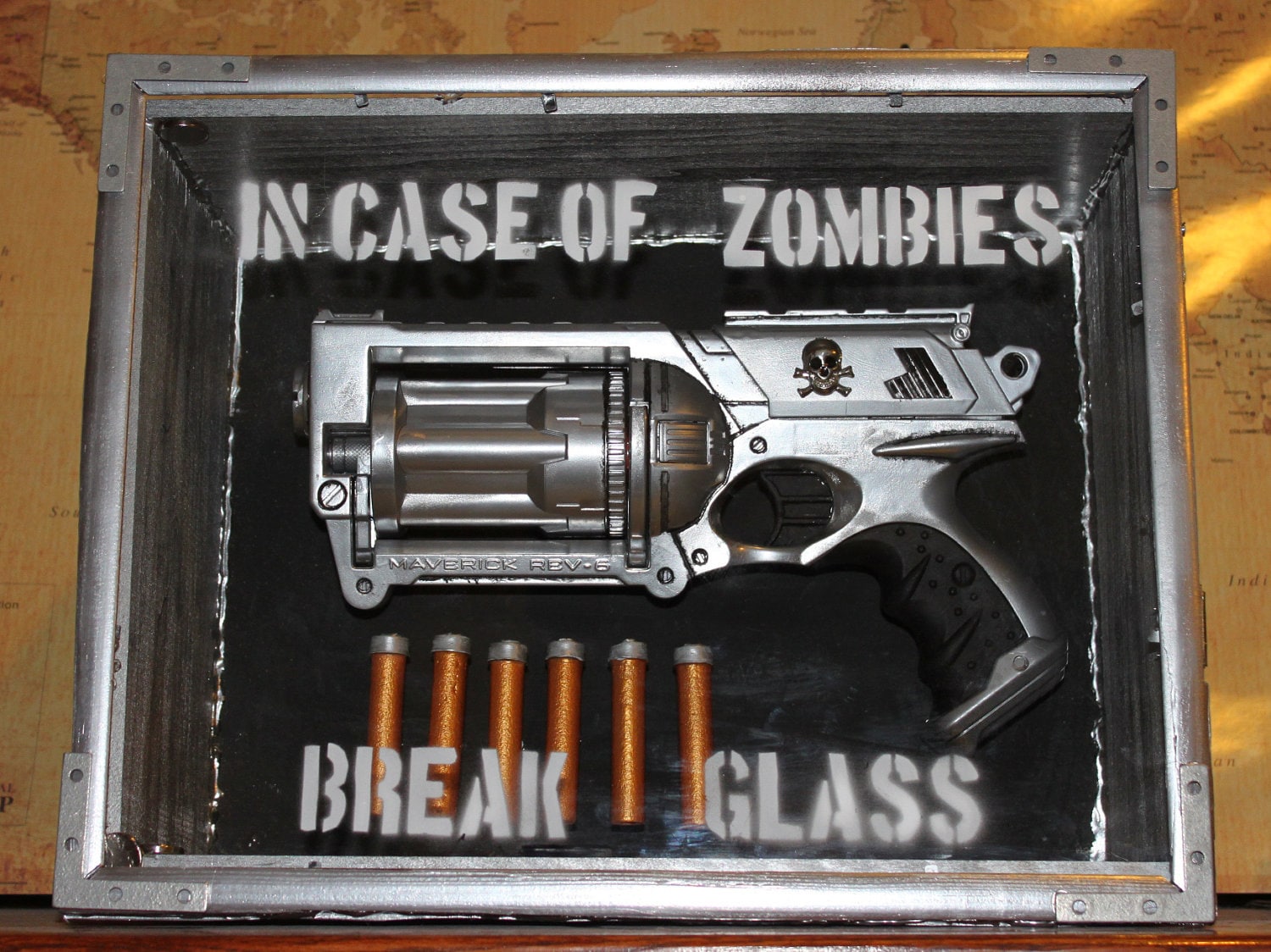

In Case Of Emergency, Break Glass

Having covered insurance, measurement and management of risk tolerance, and other topics in the last two parts of this series (here http://lifeinvestmentseverything.blogspot.com/2013/01/cutting-off-tail-part-1.html and here http://lifeinvestmentseverything.blogspot.com/2013/01/cutting-off-tail-part-2.html), I will now turn to a subject area that I hesitate to cover lest I be considered a kook or nutball survivalist. However since the topic at hand is hedging the worst outcomes so that you can sail through life in a more carefree manner I think I would be doing my readers a disservice if I did not at least mention ideas on how to mitigate the very worst situations. Accordingly, I will offer some thoughts on how to cost effectively prepare for natural and other disasters that might disrupt daily life as we know it and possibly put you and your family at risk.

Tuesday, January 29, 2013

CHK: Out With The Old...

Aubrey McClendon's Exit May Pave The Way For A Sale

After running into a cashflow shortfall and years of ethical failings, Chesapeake Energy attracted the attention of activist investors last year and the problems plaguing the company began to be resolved (see http://lifeinvestmentseverything.blogspot.com/2012/05/chk-little-help-from-your-friends.html among other past posts). Today after the close of the market the company announced that its founding CEO Aubrey McClendon will be stepping down. To be fair to Mr. McClendon, he and former partner Tom Ward (now at SandRidge Energy and also attracting activist attention) built a monster exploration and production company out of nothing. However, the long track record of poor corporate governance and the aggressive manner in which a big oil and gas company came to be run have held back the market valuation of CHK. Now that the firm has bid adieu to Mr. McClendon it would appear that there is room to change how the company is run and the valuation it receives.

I think there are three plausible outcomes for the company. First and simplest is a sale to a larger firm. There are a number of large oil majors which would find CHK's collection of drilling assets to be extremely attractive and they all have the financial wherewithal to complete the deal. Since the company's balance sheet has been backed away from the proverbial cliff, a sale could presumably be done in a non-distressed manner.

Second, the firm could simply get a new CEO more accustomed to running a firm like this in a more conservative "harvest" strategy and emerge as a credible, long term oil and gas player. Such a CEO could come from the executive ranks of an oil major and over time allow the firm to attract a higher valuation. Something similar happened to the firm now known as EOG. EOG was originally named "Enron Oil & Gas" and for obvious reasons was considerably beaten down by the market. A change of management and name plus the passage of time and EOG is now viewed as a credible oil and gas play that does not trade at a hefty discount to peers.

The third possibility is that the long-running Board investigation into Mr. McClendon's entanglements with CHK uncovered something particularly bad. If it is significant enough to affect the firm, the future might not be so bright for CHK investors. Since there appears to be no such disclosure as of this evening I am inclined to discount this possibility, but it is still possible. The stock is up some 10% after hours, so others seem to be optimistic.

In any event, it has been entertaining to watch CHK over the years and present times are no exception. I suspect that anyone who bought shares over the last year will find the outcome of the Aubrey McClendon saga to be profitable.

As always, do your own due diligence, consult your advisors and be careful. You can lose money on this stuff. Not intended as investment advice.

Disclosure: I am long CHK equity and call options.

After running into a cashflow shortfall and years of ethical failings, Chesapeake Energy attracted the attention of activist investors last year and the problems plaguing the company began to be resolved (see http://lifeinvestmentseverything.blogspot.com/2012/05/chk-little-help-from-your-friends.html among other past posts). Today after the close of the market the company announced that its founding CEO Aubrey McClendon will be stepping down. To be fair to Mr. McClendon, he and former partner Tom Ward (now at SandRidge Energy and also attracting activist attention) built a monster exploration and production company out of nothing. However, the long track record of poor corporate governance and the aggressive manner in which a big oil and gas company came to be run have held back the market valuation of CHK. Now that the firm has bid adieu to Mr. McClendon it would appear that there is room to change how the company is run and the valuation it receives.

I think there are three plausible outcomes for the company. First and simplest is a sale to a larger firm. There are a number of large oil majors which would find CHK's collection of drilling assets to be extremely attractive and they all have the financial wherewithal to complete the deal. Since the company's balance sheet has been backed away from the proverbial cliff, a sale could presumably be done in a non-distressed manner.

Second, the firm could simply get a new CEO more accustomed to running a firm like this in a more conservative "harvest" strategy and emerge as a credible, long term oil and gas player. Such a CEO could come from the executive ranks of an oil major and over time allow the firm to attract a higher valuation. Something similar happened to the firm now known as EOG. EOG was originally named "Enron Oil & Gas" and for obvious reasons was considerably beaten down by the market. A change of management and name plus the passage of time and EOG is now viewed as a credible oil and gas play that does not trade at a hefty discount to peers.

The third possibility is that the long-running Board investigation into Mr. McClendon's entanglements with CHK uncovered something particularly bad. If it is significant enough to affect the firm, the future might not be so bright for CHK investors. Since there appears to be no such disclosure as of this evening I am inclined to discount this possibility, but it is still possible. The stock is up some 10% after hours, so others seem to be optimistic.

In any event, it has been entertaining to watch CHK over the years and present times are no exception. I suspect that anyone who bought shares over the last year will find the outcome of the Aubrey McClendon saga to be profitable.

As always, do your own due diligence, consult your advisors and be careful. You can lose money on this stuff. Not intended as investment advice.

Disclosure: I am long CHK equity and call options.

Monday, January 28, 2013

WIW: Another Dollar Selling For 90 Cents

Finding Fixed Income Value In A Closed End Fund

In recent months, it has become increasingly difficult to find reasonably priced buying opportunities, especially in the realm of fixed income. Even the closed end fund (CEF) world has been bid up as there are very few funds that meet my investing criteria (market cap of at least $500MM, no excessive leverage or management fee, and at least a 10% discount to net asset value). In fact, more often than not when I screen CEFs there are no funds that meet my hurdles. However, there appears to be one very attractive bargain still available in fixed income CEFs, the Western Asset/Claymore Inflation-Linked Opportunities & Income Fund (WIW).

In recent months, it has become increasingly difficult to find reasonably priced buying opportunities, especially in the realm of fixed income. Even the closed end fund (CEF) world has been bid up as there are very few funds that meet my investing criteria (market cap of at least $500MM, no excessive leverage or management fee, and at least a 10% discount to net asset value). In fact, more often than not when I screen CEFs there are no funds that meet my hurdles. However, there appears to be one very attractive bargain still available in fixed income CEFs, the Western Asset/Claymore Inflation-Linked Opportunities & Income Fund (WIW).

Thursday, January 24, 2013

You Put Your Peanut Butter In My Chocolate!

In Brief: Chesapeake-Methanex Gas Supply Deal Portends More To Come

Today Chesapeake Energy (CHK) and Methanex (MEOH) announced a long term gas supply deal: http://methanex.mwnewsroom.com/press-releases/methanex-corporation-and-chesapeake-energy-corpora-tsx-mx-201301240848830001 The terms of the deal are that over a period of 10 years CHK will supply enough natural gas to a MEOH plant in Louisiana to produce 1 million tons of methanol annually. It takes approximately 22 MCF of natural gas to make 1 ton of methanol (http://www.methanol.org/Energy/Resources/Alternative-Fuel/Energy-Tribune-MI-Lynn-July-2009.aspx - 100 CF makes 1 gallon of methanol and there are 333 gallons of methanol in a ton), so this deal equates to about 33 BCF a year. As CHK has forecast 2013 production of 1,030 to 1,070 BCF of natural gas, this deal accounts for about 3% of 2013 natural gas production. While that may not seem like much, this deal also has a very attractive form of upside for CHK in that the price it will receive for its gas will be partially based upon the market price for methanol. Since methanol is priced at the margin based on its energy content as a substitute for oil and refined products, CHK is effectively capturing some of the price premium oil commands above natural gas of equivalent energy content. Financial details have not been released (and they are unlikely to ever become public), but if this allows CHK to sell natural gas at a 1/15th or 1/20th multiple of the price of oil instead of the current 1/27th multiple ($3.50 natural gas/$95 oil) the company gains substantial upside to the current depressed level of natural gas prices. MEOH benefits from this agreement because its feedstock costs for methanol are based on the price it receives for the finished product and so has a substantial amount of protection for its margins even if methanol prices move a long way up or down from their present level (methanol prices are volatile).

This appears to be a win-win deal for both companies. Given the current glut of natural gas in the US, I expect to see more deals structured between gas producers and large end-users that improve the long term economics of both parties' businesses. An additional benefit for the natural gas producers is that if enough of these deals are consummated (especially for new natural gas-using plant capacity), the excess supply depressing natural gas prices at present should gradually decline to yield a tighter market with more attractive spot prices for gas. If this model is attractive enough, it could even be an indication that we might see a major end user (chemical company, utility, etc.) buy a natural gas producer.

As always, the above is not intended as investment advice. Consult your advisors, do your own due diligence, and be careful. You can lose money on this stuff.

Disclosure: I have long equity positions in CHK and MEOH and I am long calls on CHK.

Today Chesapeake Energy (CHK) and Methanex (MEOH) announced a long term gas supply deal: http://methanex.mwnewsroom.com/press-releases/methanex-corporation-and-chesapeake-energy-corpora-tsx-mx-201301240848830001 The terms of the deal are that over a period of 10 years CHK will supply enough natural gas to a MEOH plant in Louisiana to produce 1 million tons of methanol annually. It takes approximately 22 MCF of natural gas to make 1 ton of methanol (http://www.methanol.org/Energy/Resources/Alternative-Fuel/Energy-Tribune-MI-Lynn-July-2009.aspx - 100 CF makes 1 gallon of methanol and there are 333 gallons of methanol in a ton), so this deal equates to about 33 BCF a year. As CHK has forecast 2013 production of 1,030 to 1,070 BCF of natural gas, this deal accounts for about 3% of 2013 natural gas production. While that may not seem like much, this deal also has a very attractive form of upside for CHK in that the price it will receive for its gas will be partially based upon the market price for methanol. Since methanol is priced at the margin based on its energy content as a substitute for oil and refined products, CHK is effectively capturing some of the price premium oil commands above natural gas of equivalent energy content. Financial details have not been released (and they are unlikely to ever become public), but if this allows CHK to sell natural gas at a 1/15th or 1/20th multiple of the price of oil instead of the current 1/27th multiple ($3.50 natural gas/$95 oil) the company gains substantial upside to the current depressed level of natural gas prices. MEOH benefits from this agreement because its feedstock costs for methanol are based on the price it receives for the finished product and so has a substantial amount of protection for its margins even if methanol prices move a long way up or down from their present level (methanol prices are volatile).

This appears to be a win-win deal for both companies. Given the current glut of natural gas in the US, I expect to see more deals structured between gas producers and large end-users that improve the long term economics of both parties' businesses. An additional benefit for the natural gas producers is that if enough of these deals are consummated (especially for new natural gas-using plant capacity), the excess supply depressing natural gas prices at present should gradually decline to yield a tighter market with more attractive spot prices for gas. If this model is attractive enough, it could even be an indication that we might see a major end user (chemical company, utility, etc.) buy a natural gas producer.

As always, the above is not intended as investment advice. Consult your advisors, do your own due diligence, and be careful. You can lose money on this stuff.

Disclosure: I have long equity positions in CHK and MEOH and I am long calls on CHK.

Cutting Off The Tail, Part 2

Assessing Your Risk Tolerance Compared With The Risks You Run

In my last post (http://lifeinvestmentseverything.blogspot.com/2013/01/cutting-off-tail-part-1.html) I offered some thoughts on how to use various forms of insurance to mitigate some large downside risks that most investors face in real life. Aside from insurable risks which tend to be characterized by low probability and high severity, every investor is confronted by risks which are much more likely and can have severities ranging from minor to extreme: portfolio risk. Much ink has been spilled over the years on how to measure your risk tolerance and as far as I can tell it remains more of an art than a science. In this post I will offer some thoughts on how to assess your risk tolerance and adjust your portfolio so that you only take risks you can live with.

In my last post (http://lifeinvestmentseverything.blogspot.com/2013/01/cutting-off-tail-part-1.html) I offered some thoughts on how to use various forms of insurance to mitigate some large downside risks that most investors face in real life. Aside from insurable risks which tend to be characterized by low probability and high severity, every investor is confronted by risks which are much more likely and can have severities ranging from minor to extreme: portfolio risk. Much ink has been spilled over the years on how to measure your risk tolerance and as far as I can tell it remains more of an art than a science. In this post I will offer some thoughts on how to assess your risk tolerance and adjust your portfolio so that you only take risks you can live with.

Tuesday, January 22, 2013

Cutting Off The Tail, Part 1

How To Ensure That You Are Protected If The Worst Happens

The US has backed away from the so-called “fiscal cliff,”

equity markets have rebounded (with the S&P500 recently at levels last seen

in 2007), volatility in the markets have declined, and junk credit spreads are

going back down to foolhardy levels. The

US housing market appears to be rising again, and the European debt crisis

seems to have died down to the level of an occasional whimper. Not that there aren’t a few clouds on the

horizon, but for now the environment appears to be reasonably calm and at least

moderately positive. Considering the

events of the last several years, an oasis of calm is a good time to double

check your preparations for calamity, financial and otherwise. In this and the next couple of posts, I will

lay out some common sense preparations everyone should make while things are

relatively good so that you don’t have to worry about the worst case scenarios

(as much) when the next period of instability inevitably comes about. As an additional bonus, having ensured that

the worst possible outcome shave been mitigated you will be free to take on

more investment and/or professional risk if you choose to do so. Fundamental to personal financial belt-and-suspenders

preparation is sufficient insurance coverage.

Friday, January 18, 2013

Safe Money Rate Alert!

Pentagon Federal Credit Union Offering An Attractive Set OF CD Rates

In the present low rate environment, it helps to keep an eye wide open for good deals to offset the generally lousy returns available on safe instruments. Previous posts have identified the most reasonable places to put "safe" money these days, and one of them is certificates of deposit (CDs). There is a big range in rates and terms between different depository institutions so it pays to shop around. At the moment, the institution that appears to be offering the best terms is Pentagon Federal Credit Union (Pen Fed), available at www.penfed.org. Pen Fed has a long history of offering above market yields on CDs and is one of the 5 largest credit unions in the US (and anyone can join by purchasing a 1 year membership to the National Military Family Association). Pen Fed is currently offering CDs with APYs ranging from 1.25% for a 1 year term to 2% for a 7 year term. These rates are far above what treasuries offer (less than 1% yield for 5 year money) and the 3 year rate is about the same as a 10 year treasuy. Better yet, if rates spike Pen Fed offers fixed early surrender penalties of 6 months' worth of interest for terms up to 4 years and 12 months of interest for 5 and 7 year terms. The math says that a 4 year CD yielding 1.85% APY would have an early surrender penalty of less than 1%, effectively granting the buyer of this CD a very cheap put option in the event of a rate spike.

To be clear, 2% and under yields will not blow the doors off for anyone. However, in a very low rate environment where competing CDs and treasuries offer a fraction of the interest Pen Fed is generously dispensing, this looks like rates worth grabbing. Be sure to stay below the deposit insurance maximums, or course.

Disclaimer: As always, due your own due diligence. Although it seems unlikely, you can probably lose money even buying a CD. Read the fine print and be careful. I have no affiliation with Pen Fed other than being a customer for a number of years.

In the present low rate environment, it helps to keep an eye wide open for good deals to offset the generally lousy returns available on safe instruments. Previous posts have identified the most reasonable places to put "safe" money these days, and one of them is certificates of deposit (CDs). There is a big range in rates and terms between different depository institutions so it pays to shop around. At the moment, the institution that appears to be offering the best terms is Pentagon Federal Credit Union (Pen Fed), available at www.penfed.org. Pen Fed has a long history of offering above market yields on CDs and is one of the 5 largest credit unions in the US (and anyone can join by purchasing a 1 year membership to the National Military Family Association). Pen Fed is currently offering CDs with APYs ranging from 1.25% for a 1 year term to 2% for a 7 year term. These rates are far above what treasuries offer (less than 1% yield for 5 year money) and the 3 year rate is about the same as a 10 year treasuy. Better yet, if rates spike Pen Fed offers fixed early surrender penalties of 6 months' worth of interest for terms up to 4 years and 12 months of interest for 5 and 7 year terms. The math says that a 4 year CD yielding 1.85% APY would have an early surrender penalty of less than 1%, effectively granting the buyer of this CD a very cheap put option in the event of a rate spike.

To be clear, 2% and under yields will not blow the doors off for anyone. However, in a very low rate environment where competing CDs and treasuries offer a fraction of the interest Pen Fed is generously dispensing, this looks like rates worth grabbing. Be sure to stay below the deposit insurance maximums, or course.

Disclaimer: As always, due your own due diligence. Although it seems unlikely, you can probably lose money even buying a CD. Read the fine print and be careful. I have no affiliation with Pen Fed other than being a customer for a number of years.

Subscribe to:

Comments (Atom)